Compute Storage Cloud Infrastructure in 2Q22

Increased 22% Y/Y to $22.6 billion.

This is a Press Release edited by StorageNewsletter.com on October 6, 2022 at 2:02 pm

According to the International Data Corporation‘s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud deployments, including dedicated and shared IT environments, increased 22.4% Y/Y in 2Q22 to $22.6 billion.

Spending on cloud infrastructure continues to outgrow the non-cloud segment although the latter had strong growth in 2Q22 as well, increasing at 15.2% Y/Y to $17.3 billion. An infrastructure refresh cycle, increasing prices, system shipments toward the accumulated backlogs from previous quarters, and anticipation of tougher economic conditions, which might impact IT spending in the upcoming quarters, all contributed to the atypically high growth in spending across both segments.

Spending on shared cloud infrastructure reached $15.6 billion in the quarter, increasing 18.9% compared to a year ago. IDC expects to see continuous strong demand for shared cloud infrastructure with spending expected to surpass non-cloud infrastructure spending in 2023. The dedicated cloud infrastructure segment grew 30.9% Y/Y in 2Q22 to $7 billion. Of the total dedicated cloud infrastructure, 46.3% was deployed on customer premises.

For the full year 2022, IDC is forecasting cloud infrastructure spending to grow 17% Y/Y to $88.9 billion – a noticeable increase from 10% annual growth in 2021. Non-cloud infrastructure is expected to grow 6.1% to $66.4 billion. Shared cloud infrastructure is expected to grow 15.1% Y/Y to $61 billion for the full year while spending on dedicated cloud infrastructure is expected to grow 21.4% to $27.9 billion for the full year.

The analyst firm tracks various categories of service providers and how much compute and storage infrastructure these service providers purchase, including both cloud and non-cloud infrastructure. The service provider category includes cloud service providers, digital service providers, communications service providers, and managed service providers.

In 2Q22, service providers as a group spent $22.6 billion on compute and storage infrastructure, up 19.7% from 2Q21. This spending accounted for 56.7% of the total market.

Non-service providers (e.g., enterprises, government, etc.) increased their spending at a similarly high rate – 18.5% Y/Y – setting another record quarter for growth in this segment driven by deployments of dedicated clouds in addition to developments mentioned above. It is expected compute and storage spending by service providers to reach $88.3 billion in 2022, growing 13.9% Y/Y.

On a geographic basis, Y/Y spending on cloud infrastructure in 2Q22 increased in all regions except Central and Eastern Europe (CEE), which suffers from the Russia-Ukraine war. Spending in CEE declined 42.9% Y/Y. Middle East and Africa (MEA), and AsiaPac (excluding China and Japan) (APeCJ) grew the most at 41.6% and 40.0% Y/Y respectively. All other regions demonstrated growth in the low teens to 25% range, making 2Q22 one of the strongest quarters for cloud infrastructure investment growth across the globe. For 2022, cloud infrastructure spending is expected to grow in all regions except CEE, with three regions, APeCJ, MEA, and Western Europe, expecting to post annual growth in the 20-25% range.

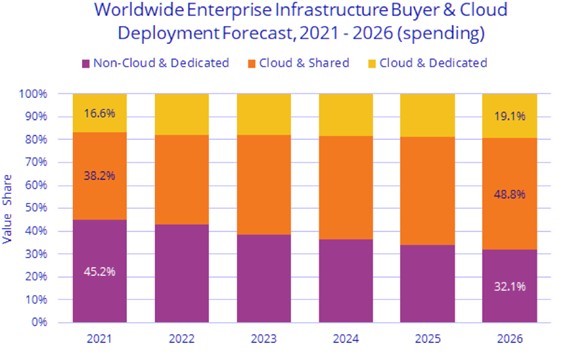

Long term, IDC predicts spending on cloud infrastructure will have a CAGR of 12% over the 2021-2026 forecast period, reaching $134 billion in 2026 and accounting for 67.9% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 71.9% of the total cloud amount, growing at a 12.7% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 10.4% to $37.7 billion. Spending on non-cloud infrastructure will grow at 0.2% CAGR, reaching $63.4 billion in 2026. Spending by service providers on compute and storage infrastructure is expected to grow at a 10.9% CAGR, reaching $130.2 billion in 2026.

Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce.

Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

Category: Uncategorized